Discount Rates and the Time Value of Money

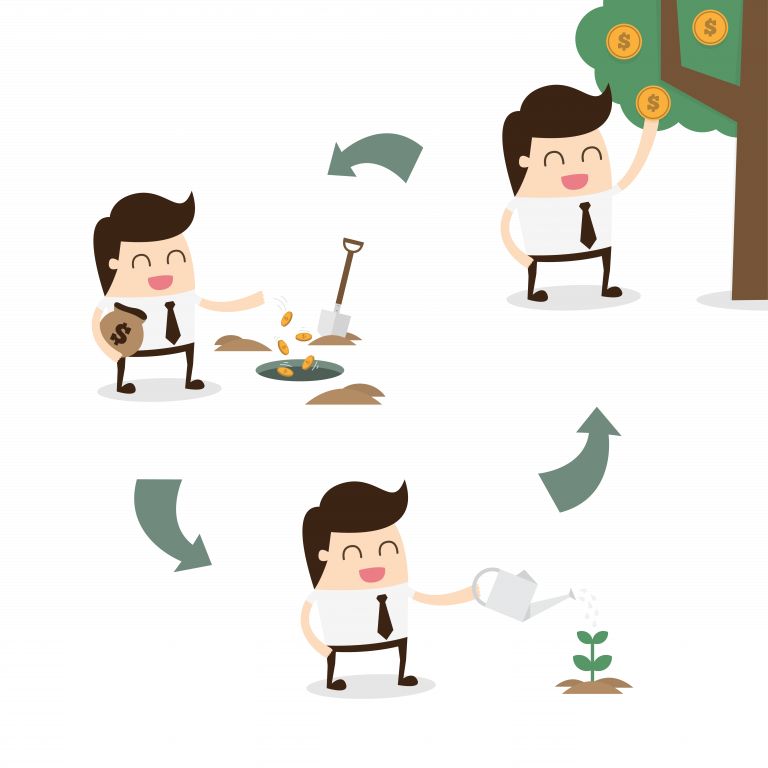

The time value of money refers to how much money that is in your hand now would be worth in the future, or how much future money is worth compared to now. What this means is that money in your hand now will be worth less in the future due to inflation.

Let’s look at selling my structured settlement on average… say that the inflation rate average over the next 10 years is 2-4% a year, a common average in the United States. Now, say that you put $1,000 under your mattress in January of 2014. Then, in January of 2015 you took that $1,000 out. Your $1,000 will only buy what about $960 could have bought in 2014. That is because something that costs $1,000 in 2014 will likely cost $1,040 in 2015 – prices have gone up but your money didn’t grow.

If you put that $1,000 under your mattress in January of 2014 and you took it out in January of 2024, that is ten years later, the money would have much less value because inflation of about 2-4% a year would have occurred. So, now your $1,000 would only buy what about $750 would have bought when you put the money away. So if you wonder about selling my structured settlement on average, yes, your money will be worth less in the future and that is a consideration in whether to sell or not.

This means that if you receive a structured settlement payment of $1,000 now it has a time value of $1,000. But if you receive that same payment in 10 years it only has a time value of about $960, at most. Of course, you also have to consider the interest that can be earned on annuities – this varies, but is part of the equation.

Time value is a lot more complicated than this simple inflation example, as is calculating structured settlement annuity rates and discounts. But the point is that when you consider the time value of money, and add to that the fact that any company buying your payments will need to make a profit, you can see a substantial decrease in how much you get for your future payments versus what you may think they are worth – this is called the “discount rate”, the rate by which your future payments are “discounted” to come up with a lump sum.

The further out your payments are the more they are discounted, so the rate will actually vary each year. If you were quoted a discount rate it is probably the average rate of the sale of all your payments. This means that if you sell a payment due next month the discount rate might be just 4%, but if you sell a payment for ten years from now the discount rate might be 16% on that payment. Often, you will be quoted the “average” discount rate for all of these payments together. So, if you sold just these two payments your “average” discount rate for both payments would be 10%.